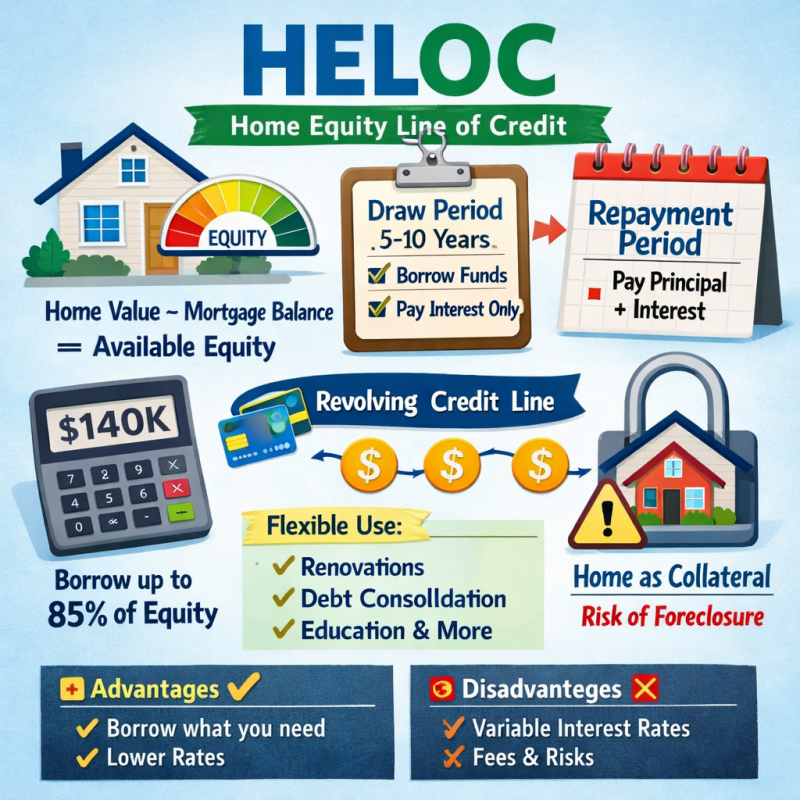

HELOC (Home Equity Line of Credit) is a line of credit secured by the equity in your home. It works similarly to a credit card, but your house is used as collateral.

ð What is a HELOC?

A HELOC (Home Equity Line of Credit) is a revolving line of credit that allows you to borrow against the equity you’ve built in your home.

Your home equity is calculated as follows:

Market value of the home – remaining mortgage balance = available equity

ð§ How it works

ð¡ 1. Draw period

-

This is the period during which you can withdraw funds from the credit line.

-

It typically lasts 5 to 10 years.

-

You usually pay interest only on the amount you actually use, not on the total approved limit.

ð 2. Revolving credit line

-

Similar to a credit card: you can borrow and repay repeatedly during the draw period.

-

When you repay part of the balance, that amount becomes available again.

ð» 3. Repayment period

-

After the draw period ends, the loan enters the repayment (amortization) phase.

-

You can no longer withdraw funds, and you must repay principal + interest.

-

This period often lasts 10 to 20 years.

ðµ How much can you borrow?

Lenders usually allow you to borrow up to a percentage of your home’s value, commonly:

ð¹ Up to 85% of the home’s market value

ð¹ Minus the balance of your existing mortgage

Example:

ð Interest rates

ð Variable rates

Most HELOCs have variable interest rates, typically tied to an index such as the Prime Rate + a margin.

ð Fixed-rate options

Some lenders allow you to lock in a fixed rate on a portion of the balance.

â Advantages

â You borrow only what you need

â You pay interest only on the amount used

â Flexible use of funds (renovations, debt consolidation, education, etc.)

â Interest rates are usually lower than credit cards or personal loans

â Disadvantages and risks

â Your home is used as collateral — failure to repay can lead to foreclosure

â Variable rates may increase, raising your monthly payments

â Possible fees: application, appraisal, annual fees

𧾠Common uses for a HELOC

-

Home renovations or improvements

-

High-interest debt consolidation

-

Medical or education expenses

-

Emergencies or investment opportunities

ð Key differences compared to other products

| Product | Collateral | Flexibility | Interest |

|---|---|---|---|

| HELOC | Home | High | Variable (usually lower) |

| Home equity loan | Home | Lump sum | Fixed |

| Credit card | None | High | Much higher |