Record sales: Have New York, Miami office markets found the floor?

Has the office market hit its bottom? A couple of major deals in Miami and New York have raised that question.

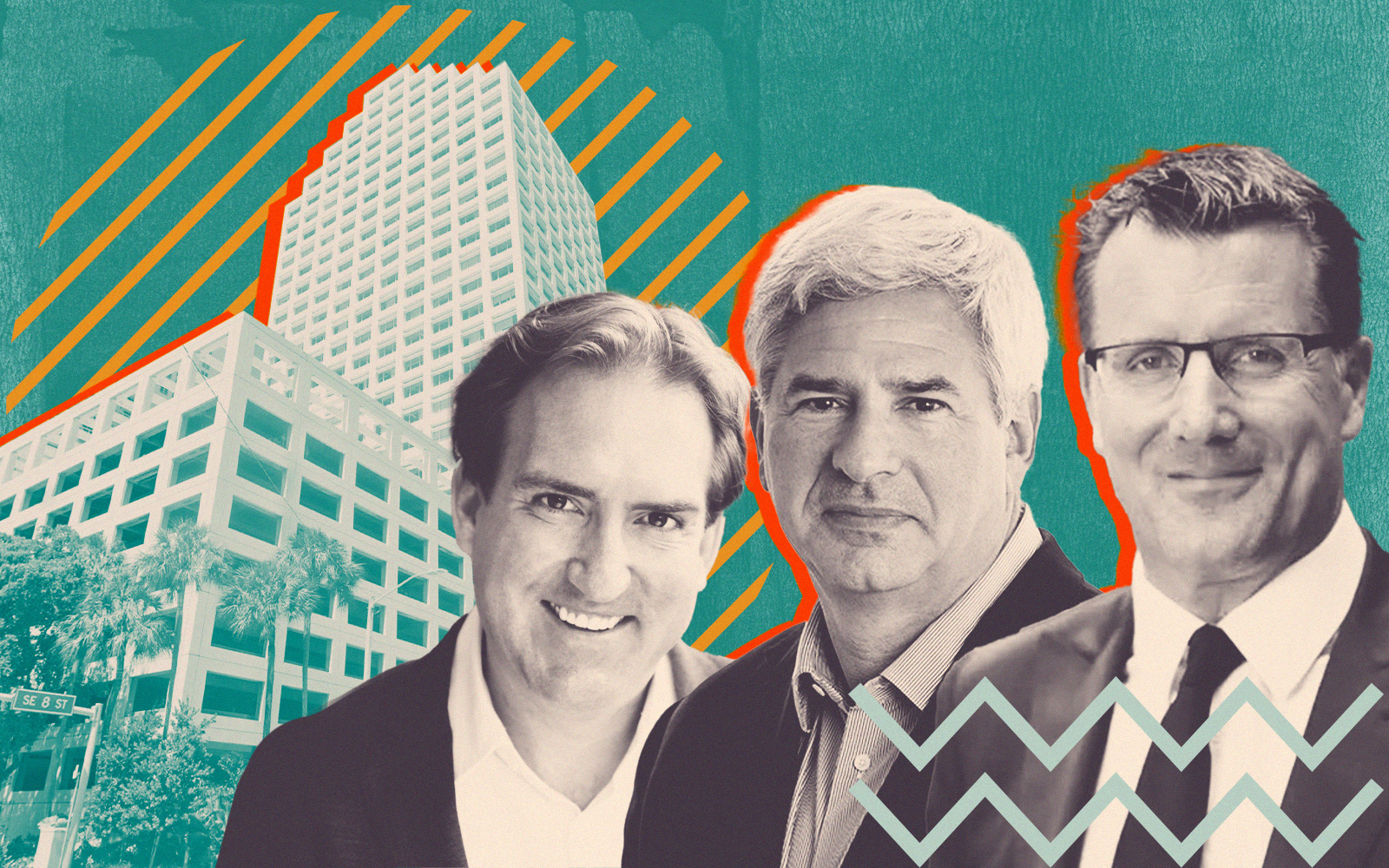

South Florida’s office sales market has been crawling along all year, but it just got a shot in the arm, thanks to a sale in Brickell, a trendy Miami neighborhood. Monarch Alternative Capital and Tourmaline Capital Partners purchased the office building for a price in the mid-$200 million range, which would make it the region’s priciest office sale of the year.

In New York, Wells Fargo purchased a soon-to-be converted retail space at Hudson Yards for $550 million. The 400,000-square-foot space was once home to Neiman Marcus’s flagship store, but it sat empty for the last three years following Related’s decision to convert the space to office. The sale is expected to end the year near among the city’s priciest deals.

The office market’s arrow has been pointing down all year, and recent office attendance trends suggest that won’t end anytime soon. But the industry has been waiting for distressed property buyers to swoop in and establish a price floor.

The recent sales show that may finally be happening, if only for true cream-of-the-crop assets.

In Miami, buyers Monarch and Tourmaline got a solid asset. The 28-story office tower is over 90 percent leased. It’s also in a burgeoning neighborhood — South Florida’s last record sale was a few blocks away, where Citadel’s Ken Griffin paid $286.5 million for a tower last summer.

In New York, Hudson Yards has emerged as one of, if not the most attractive office properties in the city.

So, top-notch assets may have finally found the basement. The rest of the market may have to wait.